USDA

If you're purchasing in a rural or suburban area, a DPA loan makes homeownership more accessible by offering advantages that cater to your location and income.

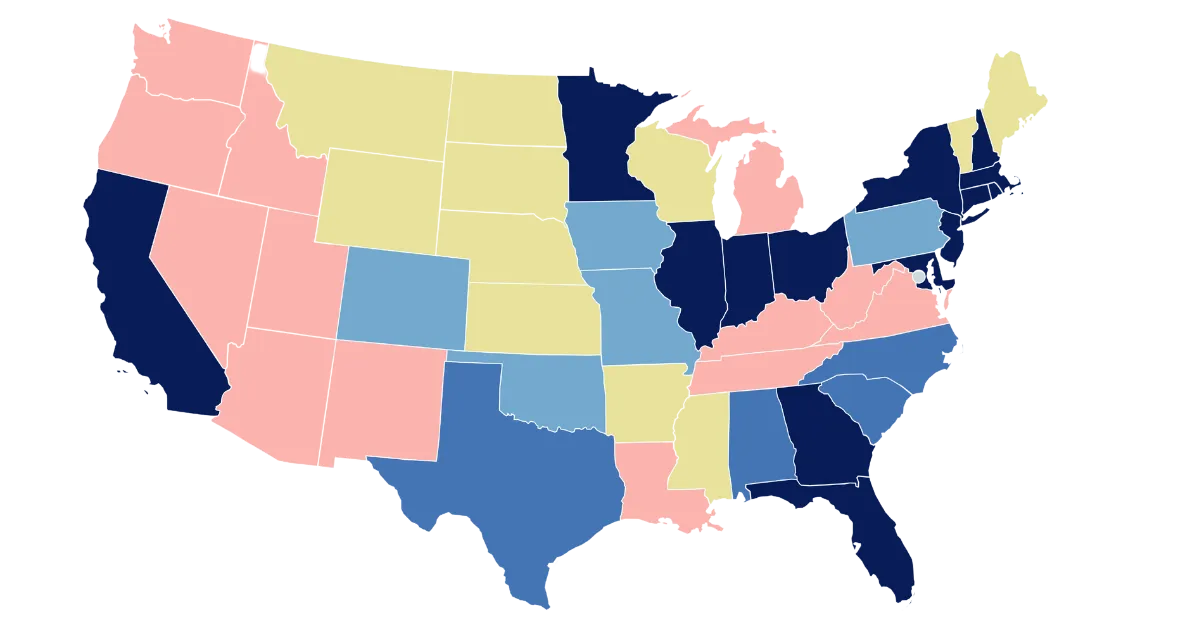

Geographic Focus

Backed by the United States Department of Agriculture, USDA loans aim to facilitate homeownership in regions with lower population densities.

Zero Down Payment

Distinctive to USDA loans, you have the potential for zero down payment. Particularly beneficial if you have limited liquid assets, as it reduces the upfront financial burden associated with home purchases.

Income-Driven Accessibility

Designed to support households across a spectrum of income levels, USDA loans fit with the mandate to enhance economic opportunities and improve quality of life in rural communities.

Competitive Interest Rates

Despite being government backed, USDA loans often offer lower interest rates, providing you with favorable borrowing terms. This can save you money long term compared to alternative financing options.

Lender Collaboration

Securing a USDA loan necessitates collaboration with an approved lender. We provide you support, ensuring adherence to established lending standards, and make sure you get access to all the benefits available to you.

Looking to buy a home in the countryside?

Benefit from zero down payment options, competitive interest rates, and tailored support.

Enjoy the peace of rural and suburban living with financial peace of mind.

Cindy Regan, All Rights Reserved

Cindy Regan - Originating Branch Manager - NMLS #264375

The Lending Authority Team - Hancock Mortgage -Powered by City First Mortgage Services LLC - NMLS #3117

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. The Lending Authority Team powered by City First Mortgage Services is not an agency of the Federal Government, and is not acting on behalf or at the direction of HUD/FHA.

Cindy Regan, All Rights Reserved

Cindy Regan - Originating Branch Manager - NMLS #264375

The Lending Authority Team - Hancock Mortgage -Powered by City First Mortgage Services LLC - NMLS #3117

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. The Lending Authority Team powered by City First Mortgage Services is not an agency of the Federal Government, and is not acting on behalf or at the direction of HUD/FHA.