Realtor Resources

We've created a central location for you to get answers quickly at any time, day or night.

Check Fannie Mae Condo Requirements

Occupancy Requirements

Fannie Mae wants to make sure people actually live in the condos they finance. So, at least 51% of the units in the condo building must be owner-occupied. That means the owners live there themselves.

Insurance Requirements

The condo building must have insurance coverage, including liability and property insurance. This ensures that if something bad happens, like a fire or a flood, there's enough insurance to cover the costs.

Financial Health

Fannie Mae checks the financial health of the condo association. They want to see that the association has enough money saved up for repairs and maintenance. This helps protect your investment in the condo.

Legal Issues

Fannie Mae also looks into any legal issues the condo building might have. This includes things like lawsuits or disputes. They want to make sure there aren't any major problems that could affect your ability to live in or sell the condo.

Condo Size

Fannie Mae has size requirements for condos. They prefer condos to be at least 400 square feet in size. This ensures that the condo is livable and meets basic standards.

Did You Know?

When a manufactured house has been moved from another property, a special non-conforming loan product will be required. This requires a minimum of 5% down and will have higher interest rates associated with the loan.

Listings to Leads

Listings to Leads is your ultimate ally in real estate marketing, providing a seamless platform to showcase your listings, capture leads, and nurture client relationships. With its intuitive interface and robust features like automated campaigns and social media integration, you can effortlessly expand your reach and drive growth in your business.

Through us, you can utilize these benefits at no cost. Simply fill out the form below to let us know you're interested, we'll sign you up, and you can get started on expanding your marketing!

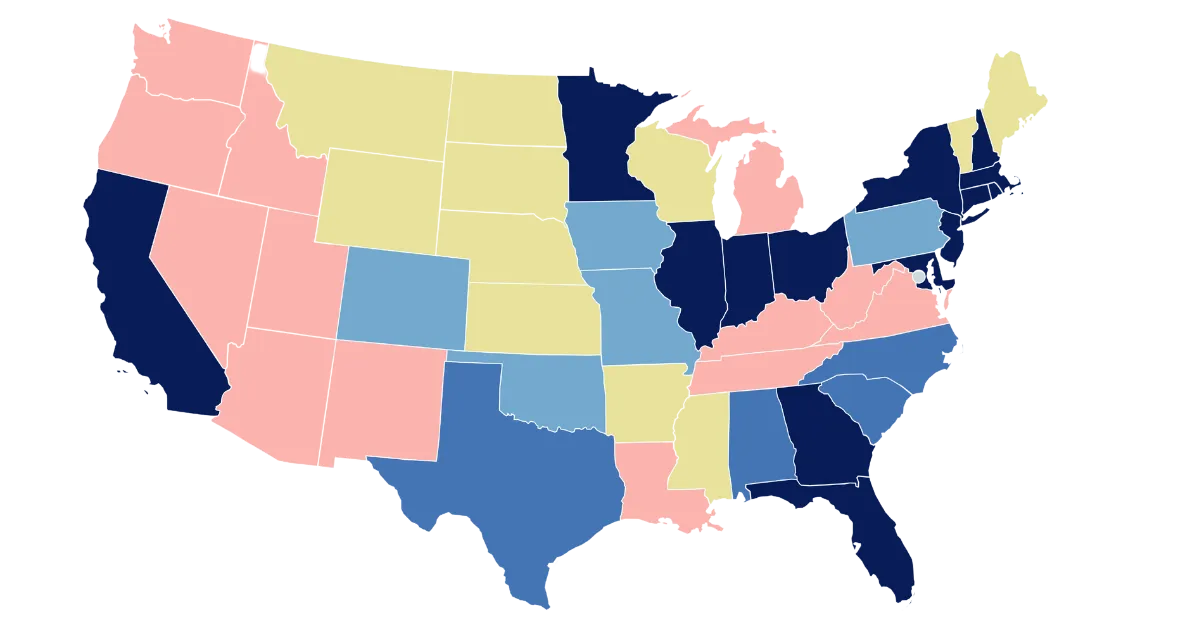

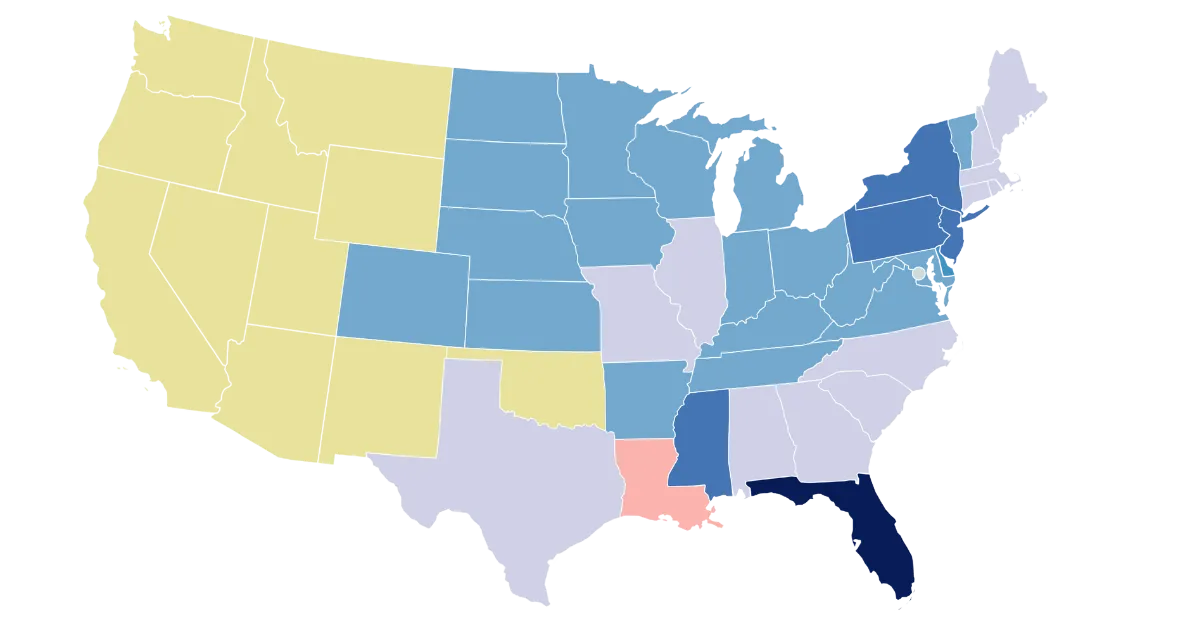

Check USDA Eligibility Zones

This button will take you to the USDA Eligibility Zone map, where you can search for properties by address.

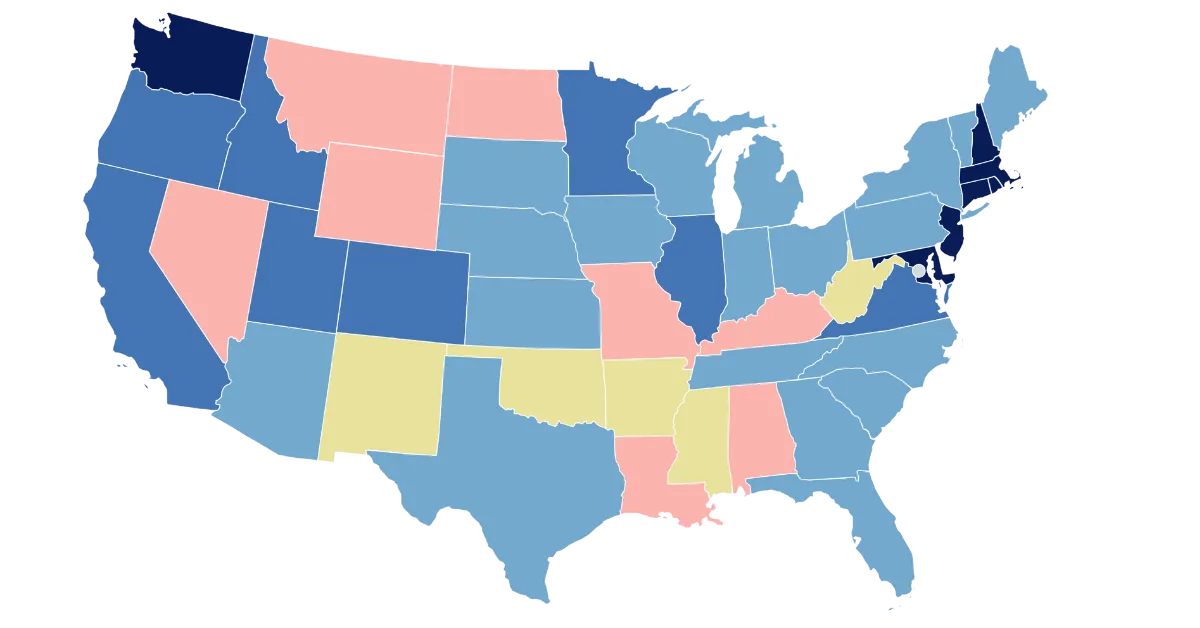

Area Median Income Lookup Tool

This button will take you to the FNMA Area Income map, where you can search for properties by address.

Check FEMA Flood Zones

This button will take you directly to the FEMA Flood Map Service Center, where you can search for properties by address.

Cindy Regan, All Rights Reserved

Cindy Regan - Originating Branch Manager - NMLS #264375

The Lending Authority Team - Hancock Mortgage -Powered by City First Mortgage Services LLC - NMLS #3117

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. The Lending Authority Team powered by City First Mortgage Services is not an agency of the Federal Government, and is not acting on behalf or at the direction of HUD/FHA.

Cindy Regan, All Rights Reserved

Cindy Regan - Originating Branch Manager - NMLS #264375

The Lending Authority Team - Hancock Mortgage -Powered by City First Mortgage Services LLC - NMLS #3117

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. The Lending Authority Team powered by City First Mortgage Services is not an agency of the Federal Government, and is not acting on behalf or at the direction of HUD/FHA.